SCS

0.0200

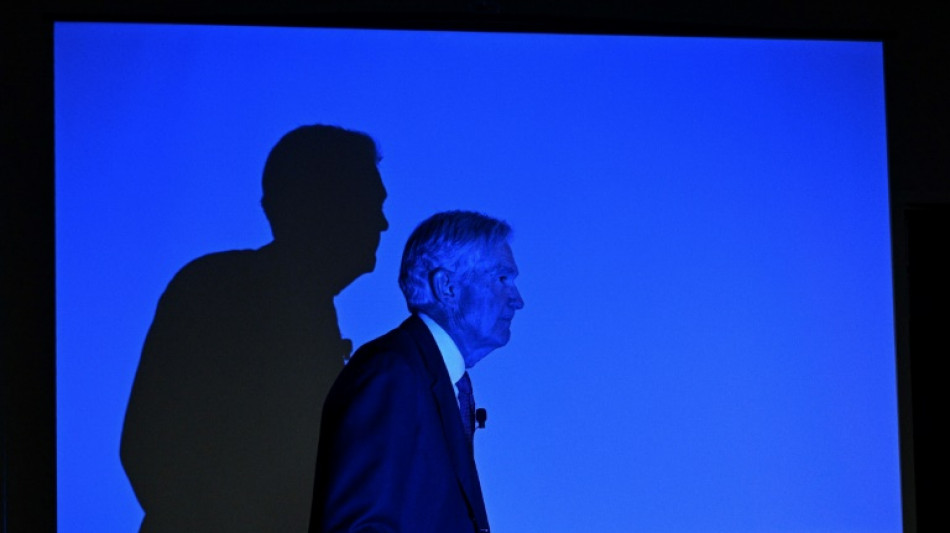

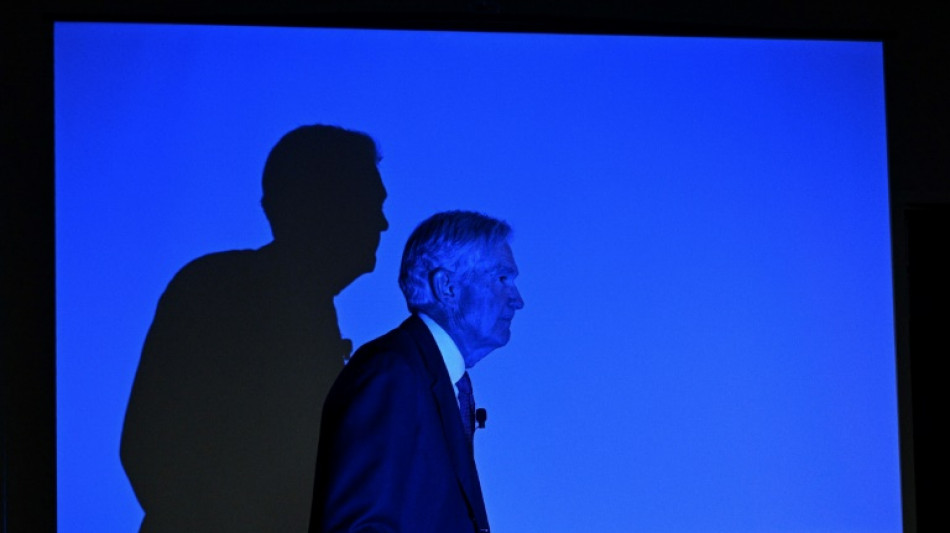

Donald Trump's simmering discontent with the US Federal Reserve boiled over this week, with the president threatening to take the unprecedented step of ousting the head of the fiercely independent central bank.

Trump has repeatedly said he wants rate cuts now to help stimulate economic growth as he rolls out his tariff plans, and has threatened to fire Fed Chair Jerome Powell if he does not comply, putting the bank and the White House on a collision course that analysts warn could destabilize US financial markets.

"If I want him out, he'll be out of there real fast, believe me," Trump said Thursday, referring to Powell, whose second four-year stint as Fed chair ends in May 2026.

Powell has said he has no plans to step down early, adding this week that he considers the bank's independence over monetary policy to be a "matter of law."

"Clearly, the fact that the Fed chairman feels that he has to address it means that they are serious," KPMG chief economist Diane Swonk told AFP, referring to the White House.

Stephanie Roth, chief economist at Wolfe Research, said she thinks "they will come into conflict," but does not think "that the Fed is going to succumb to the political pressure."

Most economists agree that the administration's tariff plans will put upward pressure on prices and cool economic growth -- at least in the short term.

That would keep inflation well away from the Fed's long-term target of two percent, and likely prevent policymakers from cutting rates in the next few months.

"They're not going to react because Trump posted that they should be cutting," Roth said in an interview, adding that doing so would be "a recipe for a disaster" for the US economy.

- Fed independence 'absolutely critical' -

Many legal scholars say the US president does not have the power to fire the Fed chair or any of his colleagues on the bank's 19-person rate-setting committee for any reason but cause.

The Fed system, created more than a century ago, is also designed to insulate the US central bank from political interference.

"Independence is absolutely critical for the Fed," said Roth. "Countries that do not have independent central banks have currencies that are notably weaker and interest rates that are notably higher."

Moody's Analytics chief economist Mark Zandi told AFP that "we've had strong evidence that impairing central bank independence is a really bad idea."

- 'Can't control the bond market' -

One serious threat to the Fed's independence comes from a case brought by the Trump administration that seeks to challenge a 1935 Supreme Court decision denying the US president the right to fire the heads of independent government agencies.

The Humphrey's Executor case could have serious ramifications for the Fed, given its status as an independent agency whose leadership believes they cannot currently be fired by the president for any reason but cause.

Even if the Trump administration succeeds in its case, it may soon run into the ultimate guardrail of Fed independence: The bond markets.

During the recent market turbulence unleashed by Trump's tariff plans, US government bond yields surged and the dollar fell, signaling that investors may not see the United States as the safe haven investment it once was.

Faced with the sharp rise in US Treasury yields, the Trump administration paused its plans for higher tariffs against dozens of countries, a move that helped calm the financial markets.

If investors believed the Fed's independence to tackle inflation was compromised, that would likely push up the yields on long-dated government bonds on the assumption that inflation would be higher, and put pressure on the administration.

"You can't control the bond market. And that's the moral of the story," said Swonk.

"And that's why you want an independent Fed."

D.Smith--NZN