RBGPF

0.1000

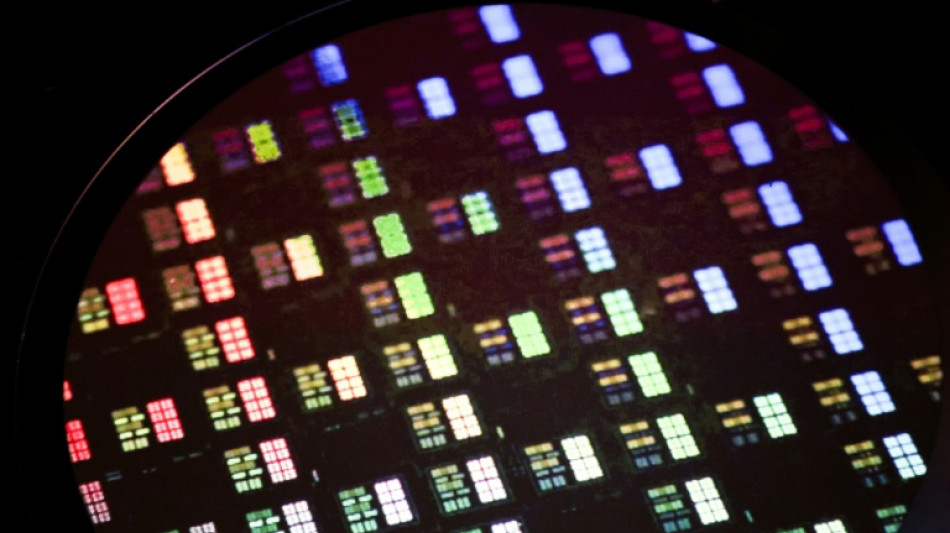

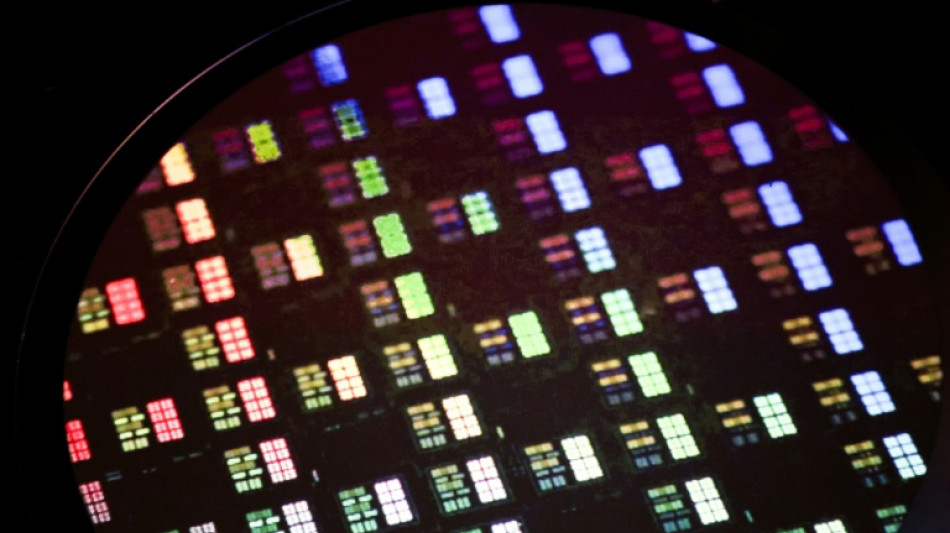

Asian equities rose Thursday, with big-name chip firms making big gains after Donald Trump said those investing in the United States would be exempted from a threatened 100-percent tariff on semiconductors.

The advances built on a strong lead from Wall Street and extended the previous day's rally fuelled by hopes the Federal Reserve will cut interest rates next month.

A day before sweeping tariffs were due to come into effect on dozens of countries, the president said: "we're going to be putting a very large tariff on chips and semiconductors".

He added that the level would be "100 percent" but did not offer a timetable.

However, he said "the good news for companies like Apple is, if you're building in the United States, or have committed to build... in the United States, there will be no charge".

Stock gains were led by Taiwan's giant TSMC, which surged almost five percent in early trade, with the island's National Development Council chief Liu Chin-ching saying the firm was in the clear.

"Because Taiwan's main exporter is TSMC, which has factories in the United States, TSMC is exempt," he told a briefing in parliament.

TSMC, which is ramping up manufacturing in Arizona, has pledged to invest as much as $165 billion in the United States, which the firm said in March was the "largest single foreign direct investment in US history".

Seoul-listed Samsung, which is also pumping billions into the world's number one economy, rose more than two percent while South Korean rival SK hynix was also up.

Apple-linked firms were also helped after the US giant said it will invest an additional $100 billion in the United States, taking its total pledge to $600 billion over the next four years.

Foxconn and Pegatron both rose in Taipei.

However, Tokyo Electron and Renesas both retreated in Japanese trade.

- Tariff talks -

"To some degree this outcome would be something of a relief," said Morgan Stanley analysts.

"Yes, 100 percent tariffs are unpalatable but if companies are given time to restore them, the real tax is just the higher cost of building chips in the United States."

Trump's remarks came hours before his wide-ranging "reciprocal" tariffs are set to kick in against trading partners, and after he doubled his levy on India to 50 percent over its purchase of Russian oil.

Fifty percent tolls on Brazilian goods came into place Wednesday, with significant exemptions, after Trump targeted Latin America's biggest economy over its prosecution of former president Jair Bolsonaro.

Investors are keeping tabs on talks between the White House and New Delhi, as well as other countries including Switzerland, which was this week hammered with a 39 percent toll.

Asian markets extended their recent run-up and have regained much of last week's losses sparked by the president's tariff announcements and weak US jobs data.

Tokyo, Hong Kong, Shanghai, Singapore, Seoul and Wellington were all in the green, with Taipei leading the way thanks to the surge in TSMC.

The gains followed a strong day on Wall Street, where Apple jumped more than five percent and Amazon piled on four percent.

Traders had already been on a buying streak as they grew optimistic that the Fed will cut rates after data last week showing US jobs creation cratered in May, June and July, signalling the economy was weakening. US futures rose Thursday.

Oil prices rose after Trump threatened penalties on other countries that "directly or indirectly" import Russian oil, after imposing his extra toll on India.

Still, traders are keeping tabs on developments regarding Moscow and its war in Ukraine after the US president said he could meet with Vladimir Putin "very soon" following what he called highly productive talks between his special envoy and the Russian leader.

- Key figures at around 0230 GMT -

Tokyo - Nikkei 225: UP 0.8 percent at 41,114.68 (break)

Hong Kong - Hang Seng Index: UP 0.3 percent at 24,985.53

Shanghai - Composite: UP 0.1 percent at 3,636.23

Euro/dollar: DOWN at $1.1657 from $1.1659 on Wednesday

Pound/dollar: DOWN at $1.3355 from $1.3358

Dollar/yen: UP at 147.50 yen from 147.38 yen

Euro/pound: UP at 87.29 pence from 87.23 pence

West Texas Intermediate: UP 0.9 percent at $64.93 per barrel

Brent North Sea Crude: UP 0.9 percent at $67.47 per barrel

New York - Dow: UP 0.2 percent at 44,193.12 (close)

London - FTSE 100: UP 0.2 percent at 9,164.31 (close)

L.Rossi--NZN