RIO

-0.2900

Stocks rose Tuesday following the previous day's stutter as more weak US data helped solidify US interest rate cut optimism and tempered nervousness over rising Japanese bond yields.

Expectations the Federal Reserve will lower borrowing costs has provided a boon to markets in the past few weeks and saw them recover early November's losses that had been stoked by fears of a tech bubble.

Bets on the central bank easing monetary policy for a third successive meeting have been rising since a number of decision-makers said protecting jobs was a bigger concern for them that keeping a lid on elevated inflation.

Those comments have been compounded by figures showing the economy -- particularly the labour market -- continues to soften while inflation appears to be stabilised for now.

The latest round of data added to that narrative, with a survey of manufacturers by the Institute for Supply Management indicating that activity in the sector contracted for a ninth straight month.

After a mixed day to start the week, Asia's markets resumed their recent rally Tuesday.

Hong Kong, Sydney, Seoul, Singapore, Taipei, Wellington, Manila and Jakarta were all up, though Shanghai dipped.

Tokyo also advanced, clawing back some of Monday's losses that came on the back of comments from Bank of Japan boss Kazuo Ueda that hinted at a possible interest rate hike this month.

The remarks boosted the yen and provided a jolt to equities as the yield of Japanese two-year government bonds rose past one percent to their highest since 2008 during the global financial crisis. The Japanese unit was steady on Tuesday.

They also helped pin back Wall Street after last week's Thanksgiving run-up and dented overall risk sentiment, pulling bitcoin back down.

Ueda's comments could mark a de-anchoring of the carry trade, in which traders borrow yen at low cost to invest in riskier assets", wrote City Index senior market analyst Fiona Cincotta.

"A higher rate in Japan could suck liquidity out of the markets. Tech stocks and crypto are particularly sensitive to even the smallest shifts in liquidity."

Still, National Australia Bank's Rodrigo Catril said Ueda also mentioned the need "to confirm the momentum of initial moves toward next year's annual spring labour-management wage negotiations".

He said that "implies that the December meeting may be too soon to have a good understanding of the wage momentum for next year".

Investors are watching nervously an auction of 10-year bonds due later Tuesday.

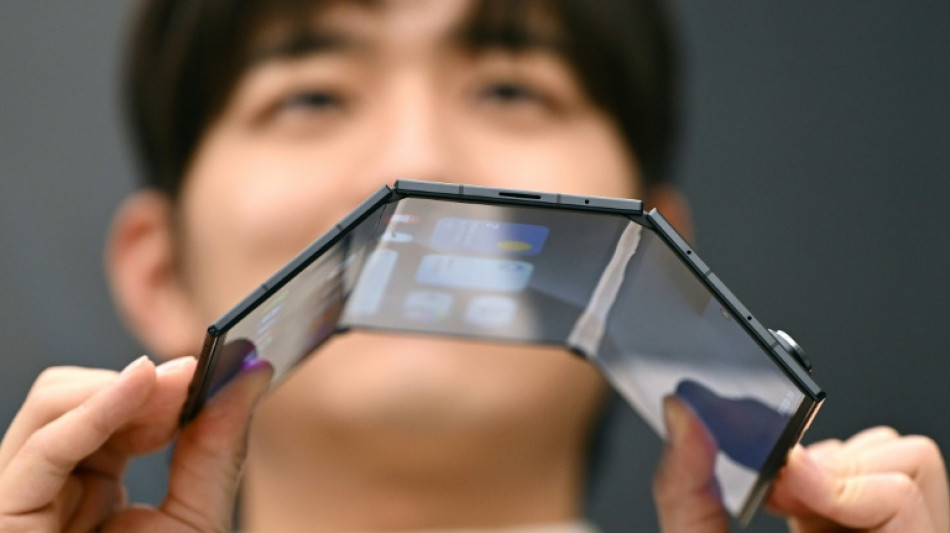

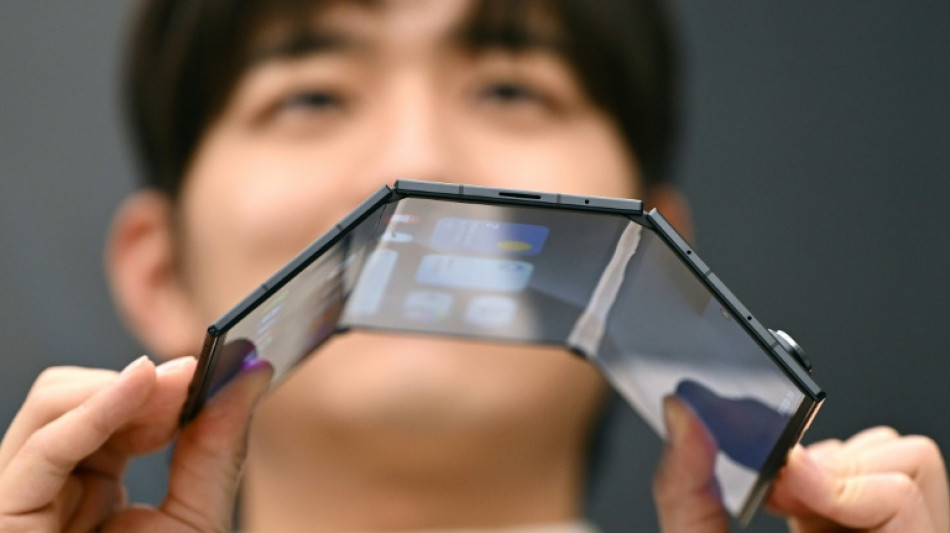

South Korean tech titan Samsung Electronics surged more than two percent in Seoul as it launched its first triple-folding phone, even admitting that its more than $2,400 price tag would place it far out of reach for the average customer.

- Key figures at around 0230 GMT -

Tokyo - Nikkei 225: UP 0.4 percent at 49,499.06 (break)

Hong Kong - Hang Seng Index: UP 0.8 percent at 26,245.11

Shanghai - Composite: DOWN 0.3 percent at 3,904.02

Dollar/yen: UP at 155.60 yen from 155.50 yen on Monday

Euro/dollar: UP at $1.1610 from $1.1608

Pound/dollar: UP at $1.3212 from $1.3211

Euro/pound: DOWN at 87.86 pence from 87.87 pence

West Texas Intermediate: UP 0.2 percent at $59.42 per barrel

Brent North Sea Crude: UP 0.1 percent at $63.23 per barrel

New York - Dow: DOWN 0.9 percent at 47,289.33 (close)

London - FTSE 100: DOWN 0.2 percent at 9,702.53 (close)

A.Wyss--NZN